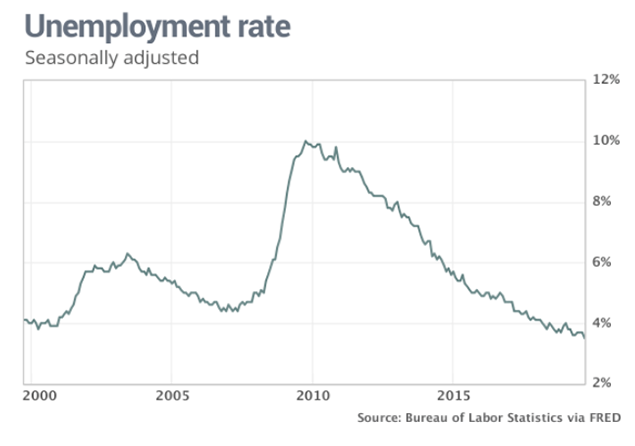

U.S. adds 136,000 jobs in September, unemployment rate hits 50-year low

The numbers: The economy added 136,000 new jobs in September, the government said Friday. Economists polled by MarketWatch had forecast a 150,000 increase.

This is the slowest pace of job growth in four months, as businesses grew more cautious about hiring, but employment gains for August and July revised up by a combined 45,000.

And in a separate survey, the U.S. unemployment rate dropped to 3.5%, the lowest rate since December 1969.

One dark spot in the report was that the increase in worker pay over the past 12 months fell to 2.9% from 3.2%. Average hourly earnings were little changed in September following an 11-cent gain in August.

What happened: With manufacturing activity weak, the bulk of the hiring in September was concentrated in the services sector. Education and health care providers filled 40,000 positions.

Government added 22,000 workers in September, but only 1,000 of the jobs were due to federal hiring for the 2020 Census. Economists had expected a much bigger increase in census workers.

Retailers shed 11,000 jobs and manufacturers dropped 2,000 workers.

Stepping back, the pace of job growth has slowed from 223,000 per month in 2018 to 158,000 over the last three months.

Big Picture: The resilience seen in the September job report will raise hopes that the economy can avoid a recession. Although manufacturing activity and business investment have been weak, consumer spending has held up well.

Many economists say the employment report is a lagging indicator and they will be watching for readings over the next few months before giving an “all-clear” sign for the economy.

The Federal Reserve has been cutting interest rates this year as insurance against a slowdown in economic growth, but the job report does not add to expectations of another cut in October.

What they are saying? “The job report is a bit of an odd duck. [But] in short, there is a lot of moderation. And the growth in the private sector is already at a pace that is border-line worrisome,” said Robert Brusca, chief economist at FAO Economics.

Market reaction The Dow Jones Industrial Average DJIA, +0.86% and the S&P 500 SPX, +0.88% jumped on relief that the report wasn’t as bad as many feared. The Dow was up by almost 200 points in morning trade.

| Marie Taylor, LEED AP Senior Vice President 626.204.1520 mtaylor@naicapital.com Cal DRE Lic #01233430 |

Nadia Maiwandi Associate 213.259.4304 nmaiwandi@naicapital.com Cal DRE Lic #01941776 |

NAI Capital 225 S. Lake Avenue Suite #1170 Pasadena, CA 91101 626.564.4800 |

No warranty, express or implied, is made as to the accuracy of the information contained herein. This information is submitted subject to errors, omissions, change of price, rental or other conditions, withdrawal without notice, and is subject to any special listing conditions imposed by our principals. Cooperating brokers, buyers, tenants and other parties who receive this document should not rely on it, but should use it as a starting point of analysis, and should independently confirm the accuracy of the information contained herein through a due diligence review of the books, records, files and documents that constitute reliable sources of the information described herein. NAI Capital Cal DRE Lic #01990696. ©2019 NAI Capital. All rights reserved. Privacy Policy |